If you’re exploring ways to unlock the value tied up in your home, equity release and lifetime mortgages could be the solution you’re looking for. These options are becoming increasingly popular among homeowners in the UK, particularly those over 55, as they offer financial flexibility without the need to sell your property or move. In this blog, we’ll explain what equity release and lifetime mortgages are, how they work, and the key things you need to consider.

What is equity release?

Equity release allows homeowners to access the cash value (or “equity”) tied up in their property. Instead of selling your home outright, you can release part of its value as a tax-free lump sum, regular payments, or both. The key advantage is that you can continue living in your home while accessing the funds.

Equity release is typically available to homeowners aged 55 and over. It’s a popular option for those looking to supplement retirement income, fund home improvements, or provide financial support to loved ones.

What is a Lifetime Mortgage?

A lifetime mortgage is the most common type of equity release in the UK. With a lifetime mortgage:

- You borrow money secured against your home.

- You retain full ownership of your property.

- The loan, plus any interest, is repaid when the property is sold – usually when you move into long-term care or pass away.

Unlike traditional mortgages, there are usually no monthly repayments unless you choose to make them. Instead, the interest compounds over time and is added to the loan balance. This makes lifetime mortgages a flexible option for those who want to free up funds without worrying about monthly bills.

How Does Equity Release Work?

To access equity release, you need to meet specific criteria, including:

- Being at least 55 years old.

- Owning a property in the UK.

The amount you can release depends on your age, the value of your home, and its condition. Generally, the older you are, the more you can borrow. Once the funds are released, you can use them for any purpose – whether it’s paying off existing debts, taking a dream holiday, or helping family members.

Key Benefits of Equity Release

- Stay in Your Home: With a lifetime mortgage, you can remain in your property for as long as you live or until you move into long-term care.

- Tax-Free Cash: The money you release is not subject to income tax, giving you access to the full amount.

- Flexible Options: Choose a lump sum, drawdown facility (to take money as needed), or a combination of both.

- Inheritance Protection: Many equity release plans offer options to ring-fence a portion of your property’s value as an inheritance for your family.

Choosing the Right Equity Release Plan

Equity release is not a one-size-fits-all solution. It’s crucial to work with a qualified financial adviser who can help you explore your options and ensure the plan you choose meets your needs. Look for advisers who are members of the Equity Release Council, which promotes high standards and consumer protection.

Why Consider Our Local Equity Release Services?

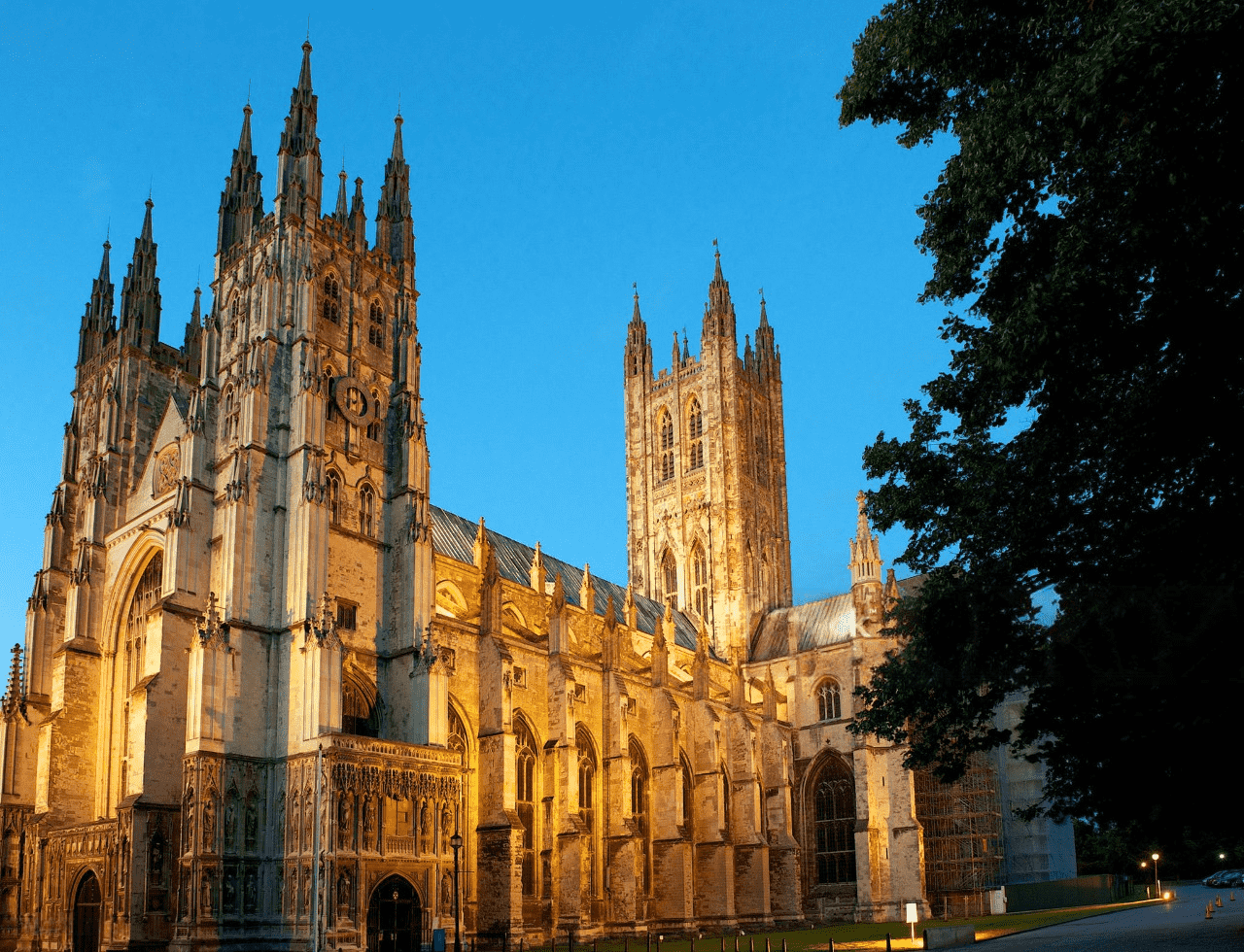

At Later Life Financial Advice, we specialise in helping homeowners in Kent make informed decisions about equity release and lifetime mortgages. Here’s why you should choose us:

- Tailored Advice: We understand that every homeowner’s needs are unique, and we’ll work with you to find the right solution.

- Local Expertise: As a trusted company in the area, we have extensive knowledge of the local property market.

- Transparent Process: We’ll guide you through every step, explaining the costs, benefits, and implications clearly.

Common Questions About Equity Release

Q: Will I still own my home?

A: Yes, with a lifetime mortgage, you retain full ownership of your property.

Q: Can I move home after taking equity release?

A: Many equity release plans allow you to move to another suitable property without penalties.

Q: How much can I borrow?

A: The amount depends on your age, property value, and the type of plan you choose.

Take the Next Step

If you’re considering equity release or a lifetime mortgage, it’s essential to get expert advice. At Later Life Financial Advice, we’re here to help you make a well-informed decision. Contact us today for a free, no-obligation consultation.